Many people are not comfortable investing 100% in equities for certain goals (and rightly so). All they want is to just have 60-70% in Equity and the rest 30-40% in Debt.

There are many ways to do this – One simple way is to have a two-fund portfolio with 60-70% in pure equity fund and 30-40% in debt fund. In this case, one needs to manually rebalance periodically and manage things in DIY mode.

The other option is that instead of separately investing in 1 equity fund and 1 debt fund each, and then worrying about ongoing rebalancing and taxes, just use one Aggressive Hybrid fund.

As per SEBI rules, aggressive hybrid funds need to have 65-80% in equity and the remaining 20-35% in Debt instruments. So here a single fund gives exposure to two different asset classes but with higher weightage to equity (which makes it quite suited for medium-long term goals). Given the 65% exposure to equity, naturally, these funds have lower equity-type risk/volatility than pure equity funds and hence, may suit a lot of not-very-aggressive investors.

What makes this category quite useful is that first – the taxation is much less at 12.5% for long-term gains (LTCG). So not only is your equity part in the aggressive hybrid scheme taxed at 12.5% but also the remaining 30-35% debt within the portfolio is taxed at that low rate! Compare this with trying to invest separately in a pure equity fund with a similar 12.5% taxation but a higher 30% (or slab-wise) taxation on debt funds. And that is not all.

Aggressive hybrid funds have another significant advantage here. When you sell equity/debt funds to rebalance periodically, then you need to pay capital gains taxes. But in the case of aggressive hybrid funds, the fund manager buys/sells equity and debt internally to periodically rebalance without triggering any tax liability for the investor! And that is because mutual funds are pass-through vehicles and any sale/purchase internally isn’t taxed.

So this is what allows Aggressive Hybrid Funds to rebalance in a tax-free manner internally.

For example – If you invest 65% in a Flexicap Fund and 35% in a debt fund. Now after a rise in equity markets, your equity:debt becomes 72:28. Now when you sell a part of equity (7%) to rebalance, you pay tax on gains. But if an Aggressive Hybrid fund goes through a similar 65:35 to 72:28 stage and rebalances back, there are no taxes to be paid on the rebalance by the fund manager or at the NAV level.

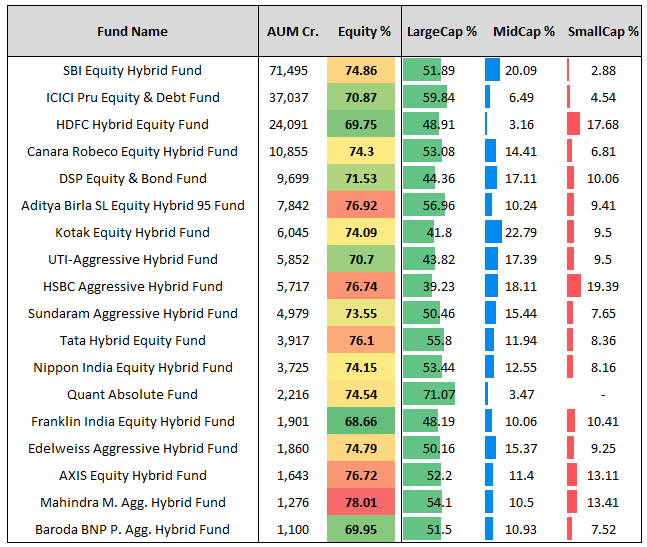

There are 30 schemes in the Aggressive Hybrid Funds category with a combined AUM of Rs 2.06 lakh crore. But the segment is top-heavy with 5 largest schemes accounting for almost 75% of the category AUM.

And while these schemes tend to have similar asset allocation, many aggressive hybrid funds invest differently across the marketcap curve and hence, one needs to pick a scheme from the category which is suitable in line with the investor’s risk profile. Here is a snapshot of the schemes with AUM>Rs 1000 Cr that shows their asset allocation and marketcap segmentation:

What about returns?

When equity markets are doing well, then obviously pure equity funds (with their ~ 90-100% equity allocation) will do well and comparatively, aggressive hybrid funds with their 65-70% allocation will seem slow. But the situation reverses when equity markets aren’t doing well. It is in such periods that 30-35% debt in aggressive hybrid funds cushions the portfolio against the falling equity markets.

To give an example, here is the drawdown profile of a popular aggressive hybrid fund from ICICI AMC (just for example):

Now compare this with the drawdowns of a pure equity fund – choosing a Nifty50 Index fund from UTI AMC for simplicity (and just as an example):

There is one place where some people have concerns about aggressive hybrids though – and that is costs or expenses. Aggressive Hybrid funds can be slightly costlier (when it comes to expense ratios) than plain equity funds or debt funds. But the weighted average. difference isn’t a lot to be a showstopper and stop people from investing in this category. And given the tax-free rebalancing that it allows (as discussed earlier), a slightly high expense ratio is fine in my view to compensate.

So in my view, at least for some set of investors, the Aggressive Hybrid Fund category can be very useful for medium-long term goals, when looked at from the lens of returns, taxation, and the ability to periodically and automatically rebalance the portfolio between 2 core assets of equity and debt.

Disclaimer – The index/funds shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor to get customized investment advice based on your risk profile and unique requirements.

Don’t Forget – Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.