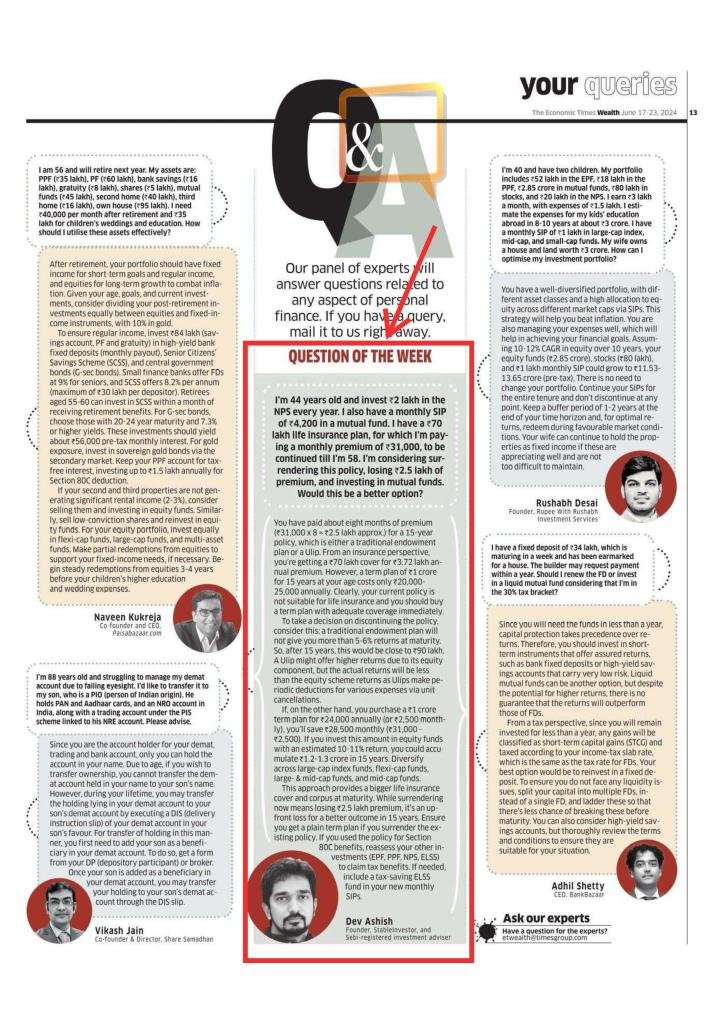

I was recently quoted in Economic Times WEALTH (17-23 June 2024) in the Q&A section where a panel of experts answers readers’ questions related to various aspects of their personal finances.

The exact question and the answer –

Here is the text version of the query and the reply –

Q – I’m 44 years old. I’ve invested in a life insurance policy with a sum assured of Rs 70 lakhs, paying a premium of Rs 31,000 per month until I turn 58. Additionally, I contribute Rs 2 lakh per year to NPS and have a mutual fund SIP of Rs 4,200 per month. I’m considering surrendering the policy, losing Rs 2.5 lakh in premiums paid, and investing in mutual funds. Would this be a better option, or is there a different strategy I should consider?

A – You have paid about 8 months premium (Rs 31,000 x 8 ~ approx. Rs 2.5 lakh) for a 15 year policy. While the policy details aren’t available, it is probably a traditional endowment-kind of life insurance or a ULIP.

If we look at it from an insurance perspective, then you are getting a Rs 70 lakh cover (+gradually accruing bonuses if any) at Rs 3.72 lakh annual premium. But a simple plain term plan of Rs 1 crore for a 15-year tenure at your age can easily be purchased at Rs 20-25,000 annual premium.

So, it is actually a no brainer that the policy you have isn’t suitable from a life insurance cover perspective and you should immediately purchase a plain term plan of adequate coverage.

Now comes the question of should you continue this policy of yours or not.

A traditional endowment-type plan will not give you more than 5-6% net returns at the time of maturity. So, after 15 years, this would be close to Rs 90 lakh. If it’s a ULIP, then the returns will be comparatively higher as there, you can choose to invest in schemes within ULIP that have a higher equity allocation. But remember that the actual returns you get will be less than the ULIP-scheme returns as ULIPs make periodic deductions for various expenses via unit cancellations.

Consider an alternative scenario now which is also being contemplated by you.

Suppose you purchase a Rs 1 crore term plan for Rs 24,000 annual or a slightly higher Rs 2500 monthly premium (as mentioned earlier). Now the remaining amount that you are left with if you surrender the existing policy is Rs 31,000 – Rs 2500 = Rs 28,500. Now assuming you have suitable risk appetite, if you invest this amount monthly in equity funds, then even at a 10-11% return estimate, the corpus you will have in 15 years would be about Rs 1.2-1.3 crore. The money can be diversified and put into 2-3 schemes from categories like Large cap Index funds, Flexicap funds, Large&Midcap, Midcap funds, etc.

So in this scenario, not only do you get a larger life insurance cover but also a bigger corpus at the time of maturity.

While surrendering now will mean losing the Rs 2.5 lakh premium as it has been less than a year for you now, this is like taking a loss upfront so that you have a better outcome after 15 years.

But whatever you decide to do, please make sure you get yourself properly insured via plain term plan if you are surrendering the existing policy.

Also, if you were using this policy to claim Section 80C benefits of up to Rs 1.5 lakh, then reassess your other investments/expenses (like EPF, PPF, NPS, ELSS) and claim the tax benefits via those. If you have no other option, then you can also include a tax-saving ELSS fund in the monthly SIPs that you might start if you surrender your current policy.