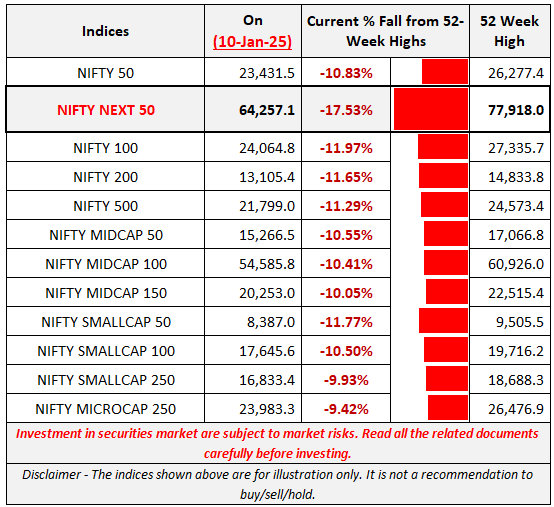

Nifty Next50 is in a kind of (red) spotlight given its sharp correction. And more so because the fall in Next50 from its highs (-17.5%) is much higher than not only to its category of largecaps, but also to mid/small/microcap indices! And the general perception is that largecaps fall less than non-largecaps.

Nifty50 is made up of the Top-50 stocks by marketcap. The other part of largecaps is the Nifty Next50 Index, which is made up of the next 50 stocks ranked 51-100 by marketcap.

And while Next50 technically qualifies as a largecap index as the constituent stocks are considered largecap stocks (as per SEBI’s current definition of largecaps being top-100 stocks), it is also true that given the nature and volatility of stocks that are part of Next50 (and comparatively larger impact costs occasionally), Nifty Next50 doesn’t behave much like a largecap index when it comes to volatility.

But with higher risks, comes higher return potential (but not assurances) of Nifty Next50 compared to Nifty50. And this return potential is what attracts most investors of Next50 to it. If we look at the broad historical market data, it will be evident that during bullish periods, Next50 generally tends to do better than Nifty50 (just look at the 1-year return of Next50 a few months back and you will know). But during market corrections, it also tends to fall more sharply.

Nifty Next 50 is generally seen as an index from where stocks move to Nifty. However, it is not as easy as it sounds due to the high marketcap entry barriers of Nifty50 stocks (now currently at Rs 1 lakh crore as per the Dec-2024 half-yearly update by AMFI). But anyway even if it is correct to an extent, it is also true that many times, those that are removed from Nifty50 (due to poor performance) end up coming into Next50. And when such stocks continue to underperform, it hurts the Nifty Next50’s return proportionately.

So one should have proper expectations from an index like Next 50. Have no doubts. Nifty Next50 is a volatile index which behaves a lot like a non-largecap index and can see periods of underperformance when compared to Nifty50. So, to put it bluntly, it is neither for the faint-hearted nor for those who are unwilling to accept high volatility. And investors also need to have the patience to live through down periods.

Related Readings:

Disclaimer – The index mentioned in this post is for illustration and educational purposes only. It should not be considered as any kind of investment advice to buy/sell/hold/etc. Please get in touch with your investment advisor to get customized investment advice based on your risk profile and unique requirements.