Gold purchase schemes offer a structured and affordable way for individuals to accumulate gold through regular, manageable monthly payments with jewellers or banks. These plans enable customers to gradually save up and purchase gold jewellery, coins, or bullion. They often come with added benefits such as discounts on making charges or value additions at maturity.

Is this the correct way to accumulate for investment in gold? Let us analyze this today.

With popular options like Tanishq Golden Harvest, GRT Golden Eleven, and many more from local jewelers to the branded ones, gold purchase schemes provide flexibility, security, and incentives for both personal use and investment, making gold accessible to a wider range of buyers in India today.

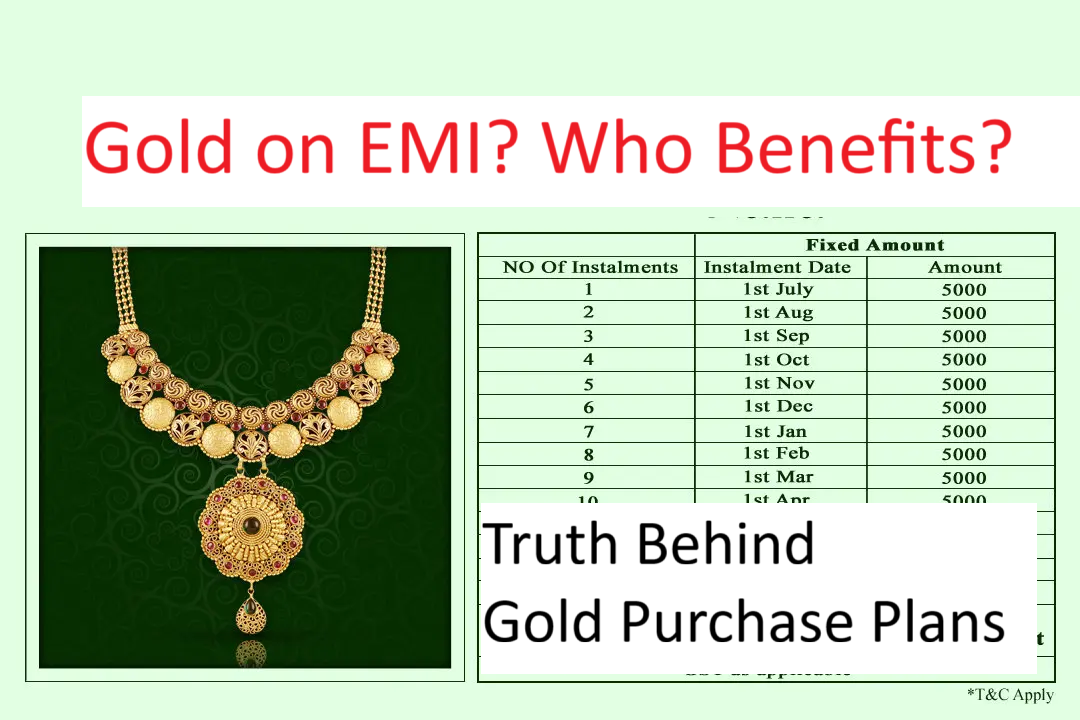

Jewelers usually run a Gold Installment Scheme to attract sales. These are not regulated schemes. One usually locks in a certain weight, say 5 grams, and then pays equal monthly payments. Usually, the installment can be for 12, 24, or 36 months. Generally, jewelers will waive the last installment, proudly announcing that they will pay it for you.

At the end of your tenure, you can buy the jewelry of the same weight or more by adding your funds. Very few NBFCs or banks also run such schemes.

Also, more freebies like discounts on making charges or converting purchases to diamond jewelry will be allowed instead of gold jewelry.

Do Gold Purchase plans make sense?

These plans do not make sense but only benefit the jeweler. They get advance money for a purchase that will happen in the future.

You will love to read this too Retirement Planning for Couples – TIPS

If you forget or wait after all installments are paid, he enjoys your disciplined savings.

When you purchase gold jewelry, you likely delay it till the next personal event or festival. Sometimes you want to buy jewelry more costly than your balance. So you wait till you have more money to add. All these procrastinated buying decisions will help the jeweler.

The waiving of the last installment is also a gimmick. Jewelers invest your monthly installments and recover that money. Remember, they are traders of gold also. They buy & sell in a commodity exchange to hedge gold prices. Even if the gold price falls, they can still make money.

Are these safe to invest?

Now, let’s consider the more practical aspects of investing in them. These schemes lack safety, liquidity & tax benefits.

No RBI or any regulator is monitoring the schemes. These may be run by jewelers of repute or maybe your local jeweler. What if it closes down or shifts business to another part of the town?

Also, you get physical gold only. We all know it is vulnerable to theft or misplacement. There is no option to get cash or gold in financial (units or bonds) form.

Also, your installments are not refunded at any cost. You will only get the gold jewelry that he is making. Whether you like it or not, need it or not, satisfied with quality & design or not, you have to buy it. You do not have the option to get money back and buy from another jeweler or invest in Sovereign Gold Bonds.

You will love to read this too Financial Planning & Health Planning

When you are buying on your own, you can always take advantage of volatility. The same EMI can be done in MFs, and when gold corrects, you can buy a larger quantity. This freedom is not there in gold installment schemes.

With increased options like Gold funds, Gold ETFs & SGB, it also makes sense to adopt these new ways. ETFs and gold MFs free you from safekeeping and also convert your investment to cash by redeeming your investment the way you sell your MF units or shares.

One can also get the benefits of tax by investing in SGB. Gold investment, if kept till maturity, is tax-free where whereas physical gold selling attracts capital gain taxes. You also need to report physical gold purchases in your ITR.

Hope the write-up clears your doubts on gold purchase schemes. Connect via email if you have any questions on the topic or general finance, or investments.