[ad_1]

Most people haven’t experienced the 2008-2009 Bear Market. And there is no way to just read about it and experience the pain. It had to be lived through. It was tough and excruciatingly painful.

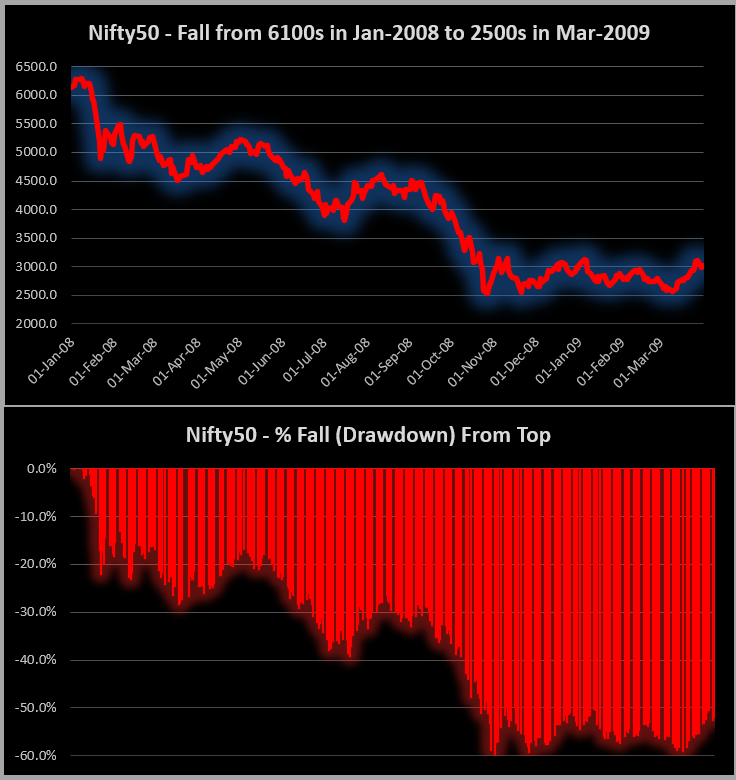

Imagine the scenario where Nifty50, the main index itself was down 60%!

And while the 13-month fall in the graph above may seem like a one-way down move in a straight line, it wasn’t. The 2008-09 bear market had a couple of strong rallies of about 20% in between. That provided some temporary relief (and hope) to everyone. But it eventually kept falling lower and lower after each rise, till it made historic lows and achieved never-seen-before drawdowns by March 2009.

And the pain down the marketcap spectrum was even deeper (or rather killer).

This is a comparison of how the drawdowns kept increasing for different largecap, midcap and small-cap indices

Horror Show! – may not be a bad phrase to sum it up. Isn’t it?

We (and I include myself) may regularly talk about having the 3Cs, i.e. Courage in times of Crisis (to invest some Cash), but the honest reality is that if and when markets do fall like this in future (and let’s hope not), all theory will be on one side and we all will have a hard time.

Please don’t consider this as an indication that I feel markets will fall like this.

Rather, this is just a small attempt to highlight what happened in 2008-09 and make people understand that those times were far more painful than what it may seem now. Just ask those who lived through and whose portfolios survived those times.

Related Reading – Nifty Crash of 21-22 January 2008 & Clustering of Big Days

Disclaimer – Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Also, the indexes shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor to get customized investment advice based on your risk profile and unique requirements.

Related

[ad_2]