How to start investing on your own

Delaying investment can be a tempting option. It’s easy to come up with various excuses such as not having saved enough money, the investment process being time-consuming, or not knowing where to begin. However, the fact is that by following a few essential steps, you can start investing with just a few hundred rupees.

Identify your goal.

Consider your desired accomplishments. Is your aim to accumulate funds for a home deposit? Are you striving to build savings for your retirement? Alternatively, are you seeking to initiate your investment journey by learning how to invest in the stock market?

Categorize your objectives into three distinct phases: short-term, medium-term (ranging from one to five years), and long-term (exceeding five years). Afterward, establish the specific amount of money you wish to save for each goal.

Invest based on your goals

It’s time to implement your investment plan and begin investing.

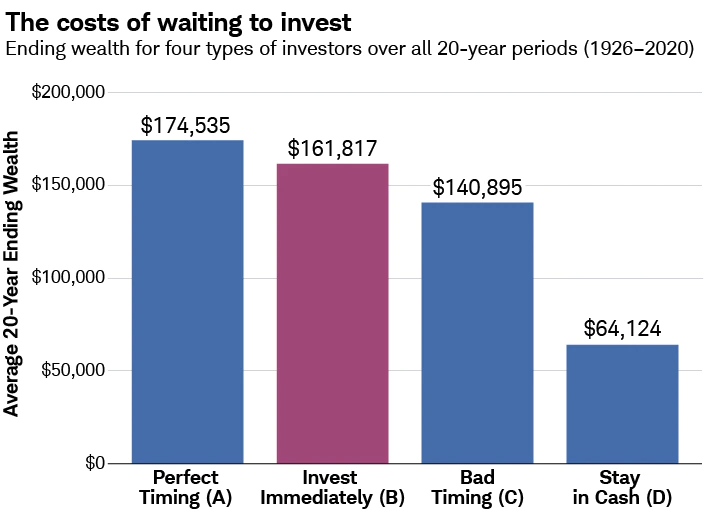

While some investors may be inclined to wait for the ideal moment to invest, initiating investments early and consistently contributing what you can typically leads to greater success than waiting.

There are many types of investments but here are some of the most common ones - organized by goal

Create a well-diversified investment portfolio that aligns with your risk tolerance.

Investing has the potential to yield returns over time, but it also carries risks. To invest wisely, you must determine the amount of risk you are willing and capable of taking on. If your investment goal is far in the future, you may have more flexibility to tolerate the market’s fluctuations. In this case, you may be comfortable with a portfolio that has a greater potential for growth but comes with a higher level of risk. However, if your investment horizon is shorter, and you cannot afford to suffer losses, you should consider a more cautious investment approach.

Risk

Risk refers to the possibility of loss arising from a particular activity or event. In the context of investing, risk refers to the potential for an investment to lose value or not achieve its expected return. Risk can arise from various sources, such as market volatility, economic and political uncertainty, inflation, and interest rate fluctuations, among others.

Risk Tolerance

Risk Tolerance refers to the degree of risk that you are comfortable taking on. It represents the level of risk that you are willing and able to withstand without experiencing undue stress or anxiety. It also have to refer the amount of risk that you can afford to take on without jeopardizing your financial objectives. It represents your financial capacity to withstand potential losses or fluctuations in the value of your investments without negatively impacting your long-term financial goals.

If you require assistance in determining your risk tolerance and risk capacity, please don’t hesitate to contact us.

Now, it’s time to turn our attention to your investment portfolio. Let’s begin with the foundational building blocks, also known as “asset classes.” We offer a diversified asset allocation that takes into account the varying behaviors of different asset classes in response to market conditions. Stocks are generally viewed as having the highest risk (i.e., potential for loss) but also offer the potential for the greatest returns. In contrast, bonds are generally seen as having lower risk but also lower potential returns than stocks, while cash has the lowest risk and potential return. This is why asset allocation, the combination of stocks, bonds, and cash in your portfolio, is so crucial. Your asset allocation should align with your investment goals, risk tolerance, and investment timeline.

Sample Model portfolios

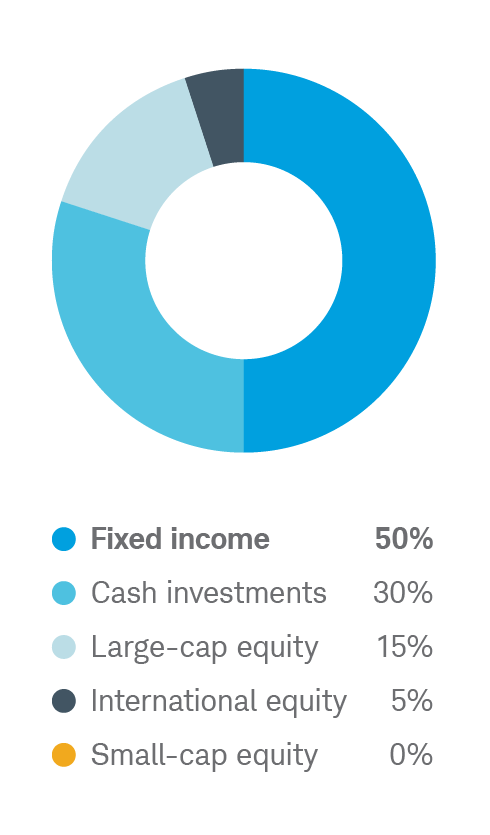

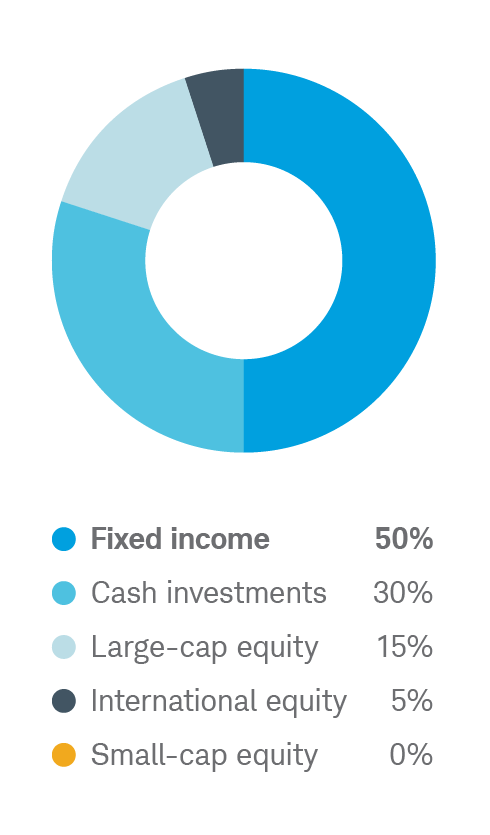

Conservative allocation

For investors who seek current income and stability and are less concerned about growth.

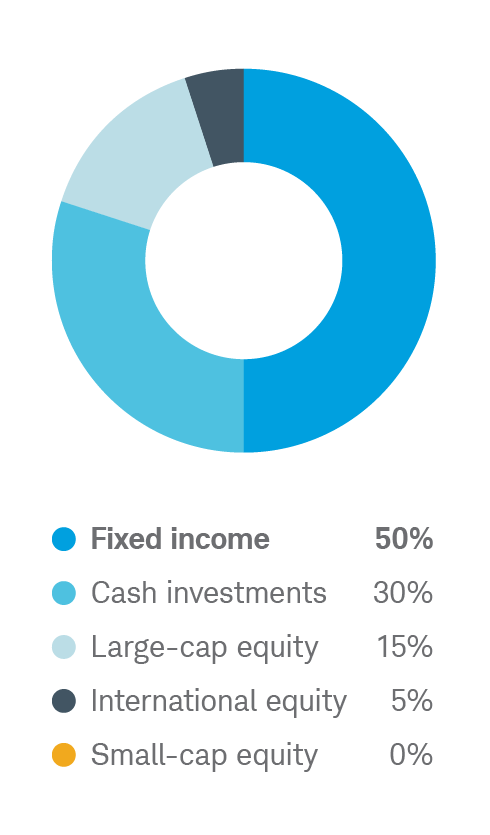

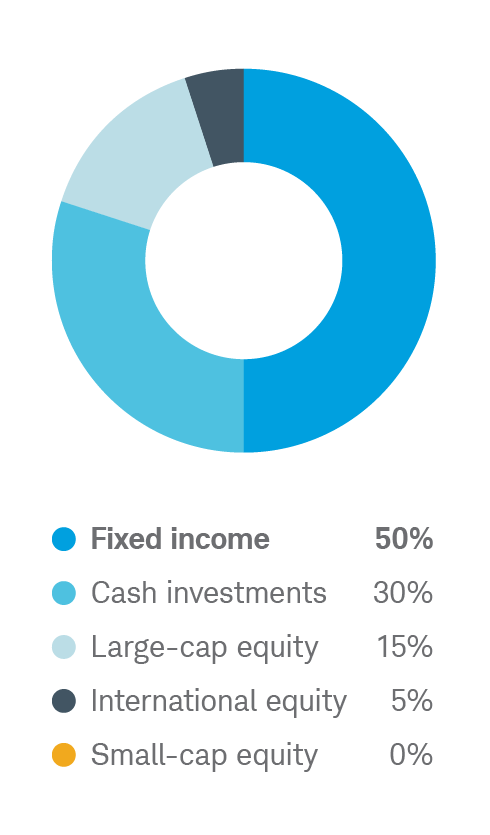

Moderately conservative allocation

For investors who seek current income and stability, with modest potential for increase in the value of their investments.

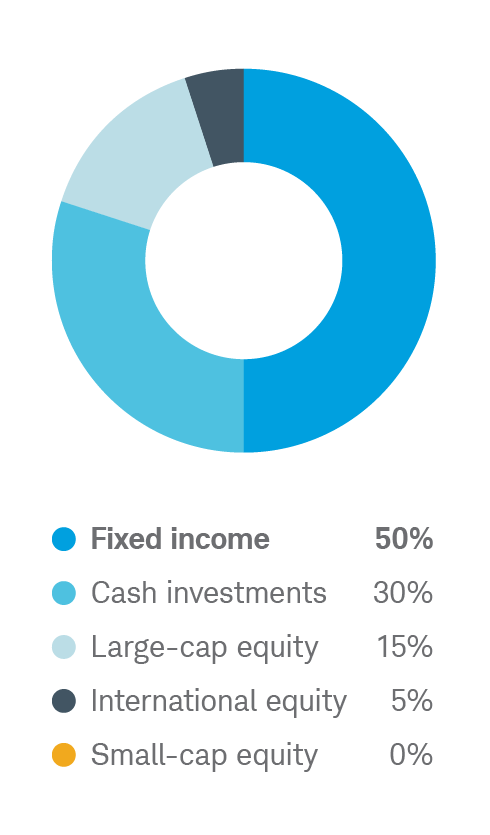

Moderate allocation

For long-term investors who don’t need current income and want some growth potential. Likely to have some fluctuations in value, but less volatility than the overall equity market.

Moderately aggressive allocation

For long-term investors who want good growth potential and don’t need current income. Likely to have a fair amount of volatility, but not as much as a portfolio invested exclusively in equities.

Aggressive allocation

For long-term investors who want high growth potential and don’t need current income. May have substantial year-to-year volatility in value, in exchange for potentially high long-term returns.

Build a portfolio in Easy Steps

You can refer to our sample asset allocation plans provided above. Typically, if you are an investor who prioritizes stability and income and has a lower risk tolerance, the conservative portfolio with a higher proportion of bonds than stocks may be more suitable. However, if you have a longer investment horizon and seek greater potential for growth, you may prefer the aggressive portfolio with a greater allocation of stocks.

Stocks and bonds can be further classified into various types based on different factors. For instance, stocks can be classified according to the size of the companies they represent, such as large-cap, small-cap, or international companies, among others. There are also various other classifications and sub-categories available to investors.

You can further diversify your investments by delving deeper into various sub-categories. For instance, with large-cap stocks, you can invest in different sectors, such as technology, healthcare, and communication, among others. Within each sector, there are different industries you can invest in. For example, within the healthcare sector, you can consider investing in pharmaceuticals, biotechnology, or medical equipment industries.

You can refer to our sample asset allocation plans provided above. Typically, if you are an investor who prioritizes stability and income and has a lower risk tolerance, the conservative portfolio with a higher proportion of bonds than stocks may be more suitable. However, if you have a longer investment horizon and seek greater potential for growth, you may prefer the aggressive portfolio with a greater allocation of stocks.

Stocks and bonds can be further classified into various types based on different factors. For instance, stocks can be classified according to the size of the companies they represent, such as large-cap, small-cap, or international companies, among others. There are also various other classifications and sub-categories available to investors.

You can further diversify your investments by delving deeper into various sub-categories. For instance, with large-cap stocks, you can invest in different sectors, such as technology, healthcare, and communication, among others. Within each sector, there are different industries you can invest in. For example, within the healthcare sector, you can consider investing in pharmaceuticals, biotechnology, or medical equipment industries.