Everyone keeps talking about how (even) Smallcap Funds gave multibagger returns from the pandemic lows of 2020 (March) till now. But what many people don’t see and realize is that the levels from where NAVs fell in March 2020, the smallcap funds already had 2 bad years preceding them from 2018-2020. And that patch of bad year (2018-2020), combined with a sharp correction in March 2020, brought down the smallcap fund NAVs to rock bottom, from where they moved up.

Here are some numbers to show how things panned out before March 2020, which then set the platform for future returns.

I have taken the current largest smallcap fund – Nippon India Smallcap Fund (Direct) as only an example below to illustrate and hence, please don’t consider it as a recommendation to buy/sell/hold of any kind.

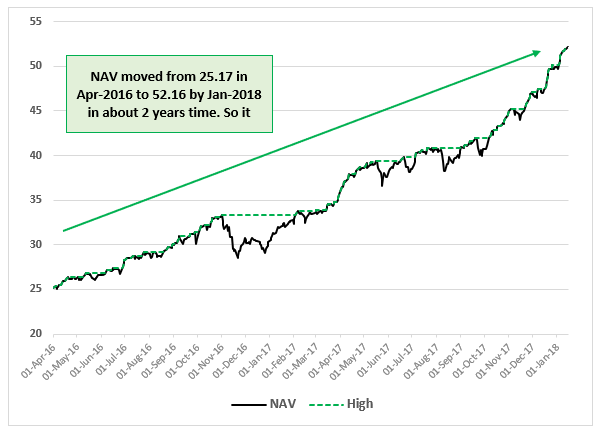

- The NAV of the fund was 25.17 on 1st April 2016.

- Over the next 20 months or so, things were good and the NAV reached a high of 52.16 on 15-Jan-2018. So it actually doubled between Apr-2016 and Jan-2018.

- Around this time, two things were happening (or about to happen). First was that just a few weeks back, SEBI had announced a massive recategorization exercise for mutual funds and hence, there was a lot of upheaval in the fund industry and portfolio during that time. The second major thing that happened a couple of weeks later on 1-Feb-2018 was in Budget 2018, the govt. shocked everyone by reintroducing the LTCG tax at 10% on equity investments. This was in early Feb-2018.

- Now see what happens next. I’m not saying it happened because of the above two factors alone, but just look at the NAV movements over the next 2 years.

- From the high of 52.6 in Jan-2018, the NAV gradually went down over the next 2 years to 41.7 by the end of Feb-2020. So that’s a fall of 20% over the period of 2 years.

- You can imagine the patience of most investors at this point in time. After a 100% move from 2016 to 2018, they were now sitting on -20% from 2018 to 2020.

- And then came March 2020 and the pain of the pandemic.

- Over the next 3 weeks or so, markets witnessed a brutal crash.

- The NAV was at 41.7 at the end of Feb-2020. By 24-March-2020, it had fallen down to 26.8. A fall of 36% in 3 weeks of time. And compared to the previous NAV-high made in Jan-2018 (of 52.6), the NAV was now down -49%. That was how brutal things were.

So what I am trying to highlight here was that smallcap space not only fell 30-40% in March-2020 itself due to pandemic fear. But even before that, it had fallen about 20% between 2018-2020 due to various other reasons. And they had become highly undervalued.

From then on, i.e. after 24-Mar-2020, everyone knows what happened.

From the NAV lows of 26.8 in Mar-2020, the NAV made a new high of 200.25 in July-2024! That’s up a monster 650% in just 4 years!

For the record, at the time of this tweet, the NAV of the said fund is at 190, which is down -5% from its high of 200.25.

So this is the story of how smallcap fund NAV behaved over the last 6+ years. Looking at returns post-pandemic lows in March-2020 in isolation doesn’t tell everything. We also need to look back a little further about how things were before 2020. So the small correction between 2018 and 2020 sowed the seeds for the future bull move, the crash of March-2020 only amplified things when it comes to the return figures.

Disclaimer – The funds/index shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor to get customized investment advice based on your risk profile and unique requirements.

Don’t Forget – Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.