In a surprising move (claimed to be towards simplification of taxation structure), the Budget 2024 has dramatically changed the Real Estate Taxation Rules in India (2024). And what is this change?

The Long-term capital gains (LTCG) tax has been changed from 20%-with-indexation to now 12.5%-without-indexation for any property sale made after 23rd July 2024.

So what has happened is that though the rate of taxation has reduced from 20% to 12.5%, the Indexation benefit available earlier on profits from the sale of the property has also been removed now. Now if you sell an old property, you will not be able to adjust (inflate) its purchase price and reduce the capital gains to be taxed.

While the government is claiming that this will reduce the actual tax outgo for most people, in reality, whether it is beneficial or not in any given scenario will depend on multiple factors like the sale price, property price appreciation, number of years, etc.

Let us try to understand what has happened.

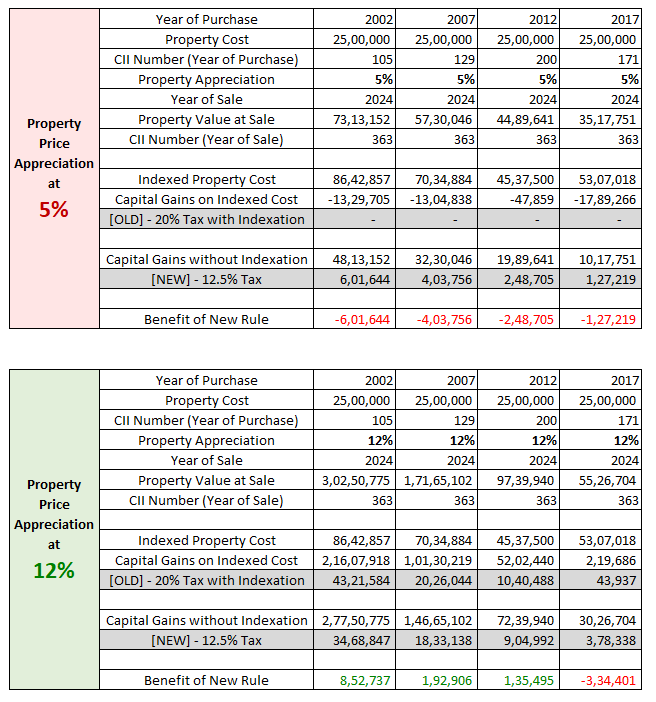

Assume four people decide to buy a property at Rs 25 lakh in different years of 2002, 2007, 2012 and 2017. And all of them decide to sell the property in 2024.

Let’s analyse the impact of the new rule across various periods mentioned above for two different types of property price growth rates. We will assume 5% in one case and 12% in another for property price appreciation. Here are the detailed results which I will explain shortly:

Now let’s focus on 2 scenarios each.

Scenario 1: Property purchased in 2002. Property prices appreciate by 5% CAGR till 2024 when the property is sold.

Please read the next paragraph which explains the table above –

A property was purchased for Rs 25 lakh in 2002. The owner holds the property till 2024 but sadly, the returns he gets on this is just 5% per annum. So he sells the property at Rs 73.1 lakh in 2024 after 22 years. Now the actual capital gain here is Rs 48.1 lakh (calculated as Rs 73.1 lakh – Rs 25 lakh). But as per the old taxation rule (20% with indexation), the purchase price of the property (Rs 25 lakh) can be inflation-adjusted. So using the CII Numbers provided by the govt. in years of purchase and sale (105 in year-2002 and 363 in year-2024), the Indexed Cost of Property comes to Rs 86.4 lakh. Now if you notice, this indexed cost of Rs 86.4 lakh is less than the actual sale price of Rs 73.1 lakh. So as per the old tax rules, the person generates a capital loss of – Rs 13.2 lakh. Since there are no capital gains in this transaction (and in fact, there is a capital loss), there is no tax to be paid. Let’s come to the new taxation rule (12.5% without indexation) scenario. Here, 12.5% tax is calculated on the actual gain on the deal, which is Rs 48.1 lakh (calculated as Rs 73.1 lakh – Rs 25 lakh). This comes to Rs 6.01 lakh which is the tax to be paid. So at least in this case, the seller is at a loss if he comes under the New Taxation Rule.

I hope this clarifies the above scenario.

Let’s take a different scenario now.

Scenario 2: Property purchased in 2007. Property prices appreciate by a solid 12% CAGR till 2024 when the property is sold.

Please read the next paragraph which explains the table above –

A property/land was purchased for Rs 25 lakh in 2007. The owner holds the property till 2024. Luckily for him, he gets super returns of 12% per annum. So he sells the property at Rs 1.71 crore in 2024 after 17 years. Now the actual capital gain here is Rs 1.46 crore (calculated as Rs 1.71 crore – Rs 25 lakh). But as per the old taxation rule (20% with indexation), the purchase price of the property (Rs 25 lakh) can be inflation-adjusted. So using the CII Numbers provided by the govt. in years of purchase and sale (129 in year-2007 and 363 in year-2024), the Indexed Cost of Property comes to Rs 70.3 lakh. Now the capital gain in this case is Rs 1.01 crore (calculated as Rs 1.71 crore – Rs 70.3 lakh). So as per the old tax rules, the person needs to pay 20% tax on indexed benefits of Rs 1.01 Cr – which comes to about Rs 20.26 lakh. Let’s come to the new taxation rule (12.5% without indexation) scenario. Here, 12.5% tax is calculated on the actual gain on the deal, which is Rs 1.46 crore (calculated as Rs 1.71 crore – Rs 25 lakh). This comes to Rs 18.3 lakh which is the tax to be paid. So unlike in the previous case, here the seller benefits if he comes under the New Taxation Rule as he has to pay comparatively lower tax.

I did some more number crunching (which is too much to add here) and found that in general, this new rule is not good for those whose property hasn’t appreciated much. So if your property prices have stagnated or seen low growth of a few percentage CAGR, then the new tax will not be in your favour. For only those whose property’s value has grown substantially at a rate much faster than general inflation (or say growth in CII numbers), they will benefit somewhat from the new LTCG 12.5% tax rule without indexation on property sales.

Interestingly, the income tax department came out with their additional views via Twitter (link) on this. In one of the tweets, it was said that – “Nominal real estate returns are generally in the region of 12-16 per cent per annum, much higher than inflation.” (see image below)

To be honest, I am not sure where they got hold of this data point. Of course, there are people who get lucky in real estate and generate huge returns, but for a majority of people across India, the real estate return outcomes aren’t that juicy as suggested by the tweet above. Just ask around yourself and you will know.

So if a property buyer doesn’t see too much price appreciation and also experiences slightly higher than above inflation (due to his own expense basket skewness towards costlier items), then this new tax will be a headache for them. In effect, by removing indexation and charging tax on the nominal gain, in a way one is paying tax on inflation too. Isn’t it?

If that is not enough, the fine print says that you can’t include stamp duty in the base price for long-term capital gains tax calculations (image below via link):

So if you buy a property for Rs 50 lakh and then pay a stamp duty of Rs 4 lakh, then the base price will still be taken as Rs 50 lakh and not Rs 54 lakh. So without indexation benefit now and a lower base price, your effective tax rate increases above 12.5%. Something else to think about.

Another issue – In the old tax system, if you had a capital loss, you could use it to set off against tax gains elsewhere on other capital assets over the next several years. But in the new tax system, the seller loses the benefit of set-off of the capital loss on the sale of capital assets with other gains during the year or the further benefit of carry forward of balance loss. This is another problem that isn’t getting much space on the discussion table.

I am not a real estate expert and in fact, don’t like it too much as an asset class (Disc: I have a bias for equities). But this new tax change may or may not work for everyone. Of course, we don’t have a choice. Nevertheless, whether you plan to purchase a ready or under-construction house (and plan to sell and pocket the profits after a few years), I hope this article gives you some clarity about the numbers and how they may or may not benefit in all scenarios.

Also, let’s remind ourselves that most people borrow to purchase a house and hence, they pay additional (home loan) interest. If that is included, then the actual cost of the property is generally much more than the base purchase price. Add to it that now, the indexation benefit is gone. So unless your property has seen good inflation-beating appreciation over the last few years of holding, the new 12.5% tax may not work in your favour in all scenarios.

![Read more about the article Why Bajaj Auto Share is Falling: Understanding the Market Reaction [17-October-2024]](https://coinfinity.in/wp-content/uploads/2024/10/Why-Bajaj-Auto-Share-is-Falling-Thumbnail-300x179.png)