Comparing Nifty50’s Past 3-Year Returns Vs. Future 3-Year Returns. Does it tell us something?

What I wanted to see was whether the returns of the past 3 years at any given point, tell us something about what will happen over the next few years in markets. So very quickly, I crunched some basic numbers for Nifty50 from Jan-1999 to July-2024, i.e. 25 years.

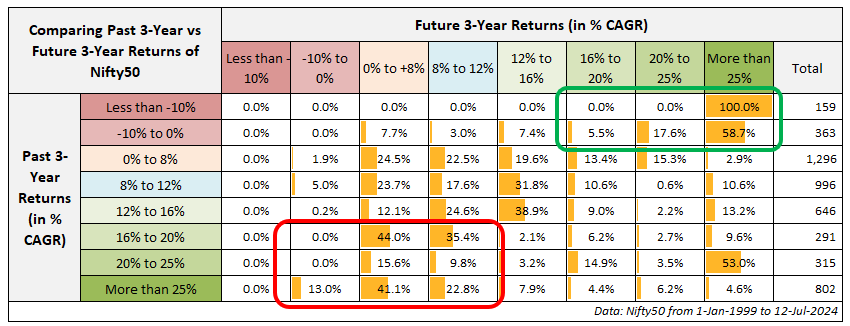

Here are the results:

In general, if the last 3-year returns of markets are subdued or not good enough, then chances of future 3-year returns being better, tend to be high (see green box above). But also when the recent past returns have been stellar, then if you believe in mean reversion, then chances are that near future returns may not be that great (see red box above).

Of course, the above thesis will not play out every time. A 3-year great run can extend to 5-6 years (let’s hope so). Similarly, a 3-year poor run can go further down (let’s hope not).

What the above dataset also points out (but not guarantees) is that – If returns in the last few years haven’t been good, then the chances of having good returns over the next few years are reasonably high.

More importantly, vice versa may be true as well and is more applicable in current times. But with the current 3-year CAGR of Nifty50 close to 16% in, and if the above historical data of 25 years is something to rely on, then it is time to be careful and rationalize our return expectations over the next few years. Not saying markets will start falling from here but that we should be careful about the near future.

And this is just about the large-cap universe (Nifty50). A similar analysis of different market segments will deliver different results. But for those heavy on mid-smallcap space, it is time to be extra cautious, please. Markets have been kind to us for a really long period this time. But markets have a different face as well (ask those who have been in markets for a longer while).

For those who want to know if there was enough sample data to rely on the probabilities in the above table, here is the datapoint count:

Disclaimer – The index/funds shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor to get customized investment advice based on your risk profile and unique requirements.

Don’t Forget – Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.