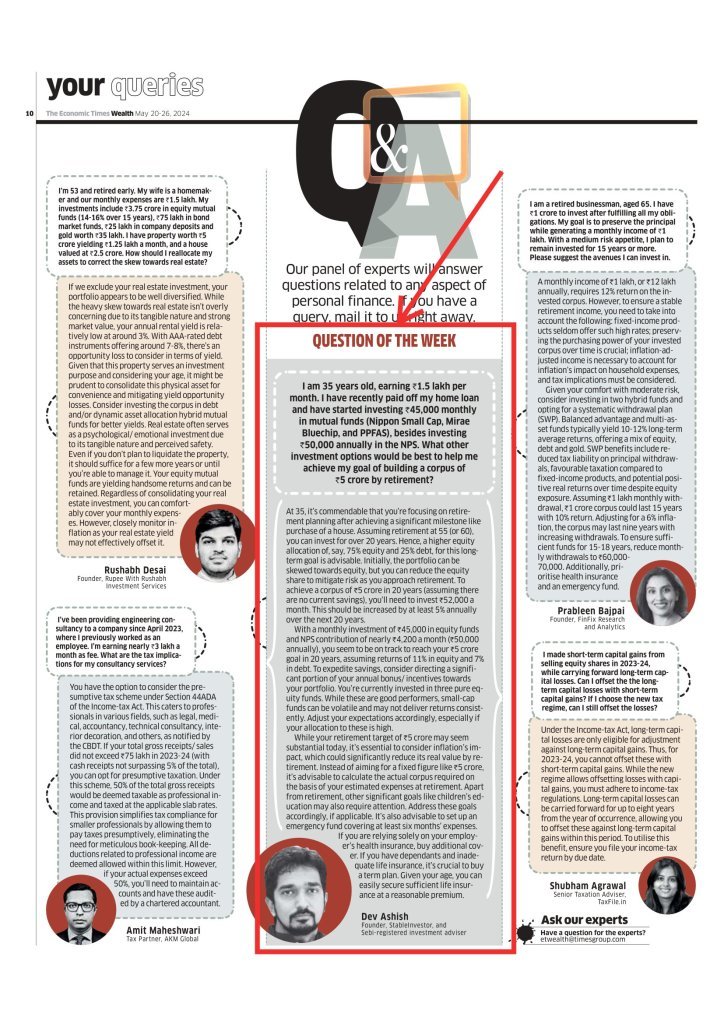

I was recently quoted in Economic Times WEALTH (20-26 May 2024) in the Q&A section where a panel of experts answers readers’ questions related to various aspects of their personal finances.

The exact question and the answer –

Here is the text version of the query and the reply –

Q – I am 35 years old, earning 1.5 lakhs per month. I have recently paid off my home loan and have started investing Rs 45,000 monthly in mutual funds (Nippon Small Cap, Mirae Bluechip, and PPFAS), along with investing Rs 50,000 annually in NPS. What other investment options would be best to help me achieve my goal of building a corpus of Rs 5 crore by retirement?

A – At age of 35, it is good to see that you are looking at retirement planning as a goal to be pursued from now itself. And best part is that you have already taken care of one of the major life goals of house purchase.

Assuming that you plan to retire at 55 (though actual may be 60), we have a considerably long runway of 20+ years. So we can safely consider a higher equity allocation for this long term goal (say something like Equit:Debt:75:25). The actual allocation will have higher equity component in initial years followed lower equity during last couple of years to de-risk the portfolio as you get closer to goal day.

Now to reach a corpus of Rs 5 crore in 20 years’ time (and assuming zero savings base currently as no information is available for the same), you need to invest close to Rs 51-52,000 monthly. Also, this investment amount needs to be increased by at least 5% each year for the next 20 years that you work.

So with an ongoing monthly investment of Rs 45,000 in equity funds and a little more via NPS annual contributions of Rs 50,000 (which is about Rs 4200 monthly), it seems you are more or less on track to achieve your goal of Rs 5 Cr in the next 20 years if our return assumptions (Equity 11% and Debt 7%) holds true. To further accelerate the savings for the goal, you can consider channelizing a major part of your annual bonus/incentives towards your portfolio if you don’t need it for other expenses or family requirements.

You are currently investing in 3 pure equity funds. Though allocations to each are unknown but these are reasonably decent funds. Smallcap funds, by nature can be volatile and no deliver returns all the time and hence, you should set your expectations accordingly. More so if your allocation to the same is on the higher side.

Another point – while you have chosen a reasonably large target (in today’s value) of Rs 5 Crore for retirement, please be reminded that the real value of this corpus will be much lower due to inflation between today and retirement day. So it would be a good idea to assess/calculate the actual corpus required based on the actual (or estimated) expenses at the time of retirement instead of going for a random, round figure like Rs 5 Cr.

Also while retirement is definitely one big goal and other house goal is already achieved, there might be other goals (like children’s education, etc.) which too might demand attention. So please cater to them as well (if applicable).

The details of short-term savings like in FDs, etc., is not known. You should look at having an emergency fund which is sufficient for at least 6 months’ worth of expenses. If you only have your employer provided health insurance, then try and get a health insurance of your own. Also, if you have dependents and you don’t have a (term) life insurance, purchase one immediately. Being relatively young, you can still get one for a small annual premium.